The Problem

When I joined the product team this new SaaS offering was being built based on initial market strategy research alone and had no pipeline to acquire early customers. Furthermore, the company’s marketing approach was focused on finished products with a legacy outbound sales model that lacked customer-driven insights or continuous iteration.

This solution was being built without the voice of the customer

Product development backlogs and solution discovery efforts were inefficient and unvalidated due to a lack of customer feedback

🛠️

💸

After over $1 million spent on strategy firms like McKinsey, there were limited funds left for solution validation and market discovery

Digital solution selling was net-new to legacy sales and marketing teams who were used to selling only finished manufactured goods, causing resistance and slow adoption

🐢

Goals

The goal was to shift this approach and drive innovation by directly addressing customer pain points and building partnerships to co-innovate. After large initial spend on strategy firms, the budget for customer discovery and proof-of-concept partnerships was constrained, making it crucial to find cost-effective methods to validate the solution's value.

My Role

As the driver of problem discovery for this SaaS solution, I was responsible for identifying and closing knowledge gaps from solution discovery teams and acquiring co-innovation partnerships with early technology adopters in our target customer profile. I managed outbound marketing strategies to gain proof-of-concept partnerships, handled stakeholder engagement across product, UX, and engineering teams, and spearheaded survey creation, managed the marketing funnel, and led customer interviews.

Process

By repurposing leftover ZoomInfo credits from our CRM partners, I was able to build a robust database of over 46,000 potential customers matching our ideal profile without any associated cost.

Armed with this database, I established a 2-month research cycle to systematically gather insights.

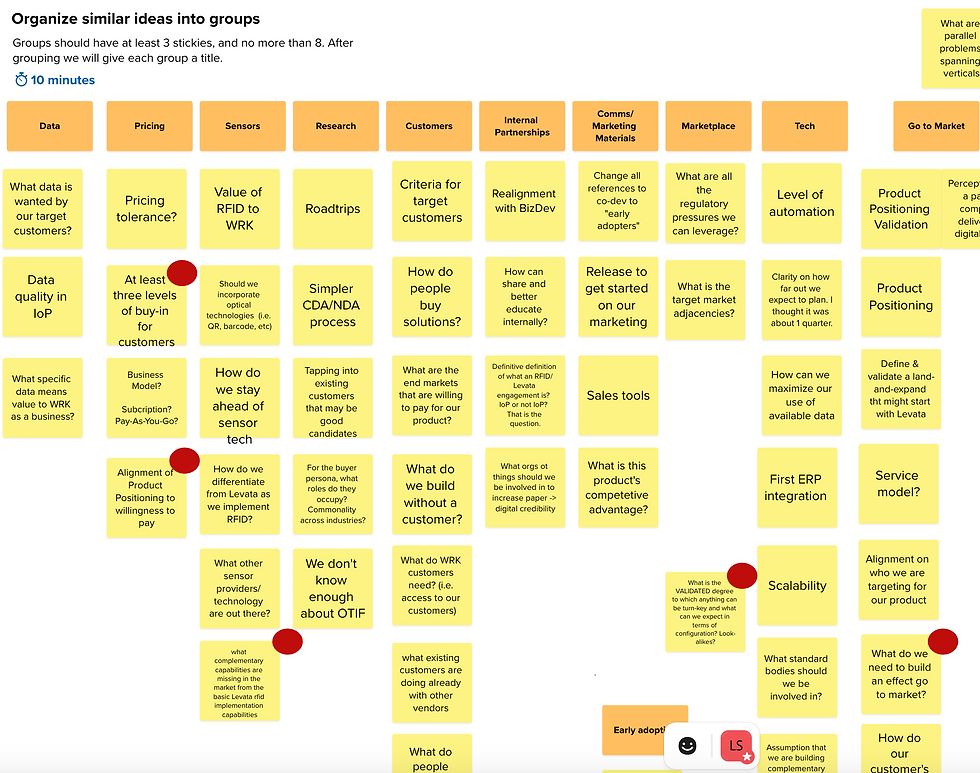

This cycle began with a design thinking session I facilitated, bringing together stakeholders from product leadership, development, UX, business development, and sales. The session aimed to collaboratively identify our team’s most significant knowledge gap about our potential users and customers.

Once a knowledge gap was pinpointed, I drafted a targeted survey to gather quantitative insights. Survey respondents were then invited to participate in 30-minute interviews for qualitative insights and be screened as potential early adopter partners to co-develop with us.

Throughout this process, I kept stakeholders engaged with regular readouts, including presentations on survey data, interview findings, and a final report summarizing all insights. Qualified leads were handed over to product leadership and business development teams for follow-up.

Solution

Through this customer-driven research, we elevated the voice of potential customers to both product teams and the company’s C-suite, delivering crucial insights on the SaaS solution's value and future market potential. The direct customer feedback provided leadership with a clear picture of market demand and helped identify likely early adopters. Product teams, equipped with specific user insights, were able to prioritize roadmap features that aligned closely with customer needs, allowing for a more informed and user-centered development approach.

At Smurfit Westrock, the video medium garnered a great deal of engagement throughout the organization. Because of this all research was converted into distributable videos, with one example here below:

Outcomes

This research process uncovered a pivotal insight: while the target market acknowledges the necessity of the solution, hesitance to invest persists until regulatory or market pressures compel adoption.

As a result, Smurfit WestRock re-evaluated its go-to-market strategy for BornDigital. While maintaining openness to co-innovation partnerships, the focus shifted toward internal use cases within Smurfit WestRock’s manufacturing facilities, where the value of tracking work-in-progress materials had already been demonstrated.

This strategic pivot allowed for experimentation with various hardware solutions to enhance accuracy and cost-effectiveness, ultimately saving the company significant time and resources that would have been wasted pursuing a market not yet ready for such an offering.

CASE STUDY

Customer-Driven Development: A Research-to-Partner Pipeline

Creating a “research to partner” pipeline from the ground up that leveraged user research to de-risk solution discovery and acquire warm leads for co-development partnerships.

Activities

User Research, Marketing

Tools

Qualtrics, Maze, PowerBI

Project Type

Research, Lead Generation

Background

Smurfit WestRock, a 100+ year-old company with 50,000 employees and over $20B in revenue, embarked on a digital transformation journey, aiming to create high-margin revenue streams through innovative supply chain solutions. The company developed a SaaS platform to track products throughout their life cycle via IoT sensors, targeting early technology adopters in perishable goods manufacturing, called BornDigital. This platform aimed to reduce waste, enhance efficiency, and improve traceability of products throughout the entire supply chain.